Grabowski Financial Planning Covid-19 Update

WE PROVIDE FINANCIAL CLARITY FOR YOU,

MOVING FORWARD IN LIFE

WE PROVIDE FINANCIAL CLARITY FOR YOU,

MOVING FORWARD IN LIFE

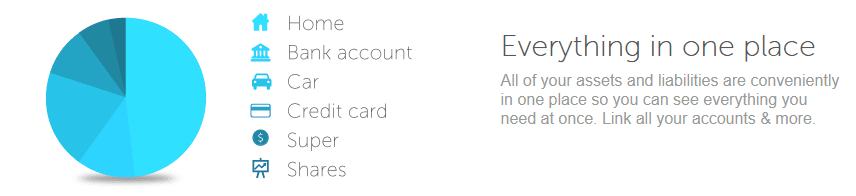

STILL USING DIFFERENT SYSTEMS TO MANAGE YOUR INVESTMENTS?

Take control of your finances today

FEATURED SERVICES

LIFE INSURANCE

At GFP, we can assist you through the maze of personal risk insurance such as life, income protection, critical illness, total and permanent disability, trauma and more

RETIREMENT PLANNING

We understand that different things matter to different people, but having a retirement plan is important for each and every one of us. We will help you set up a plan for retirment that will help your super savings go a long way.

BUDGET PLANNING

Budgeting, planning and forecasting is a process for determining and detailing an organization’s and personal, long- and short-term financial goals.

RESOURCES TO ASSIST YOU

If you require any help using these tools, please contact us.

ABOUT GFP

Grabowski Financial Planning is a financial advisory business specializing in advice on Life Insurance, Retirement Planning and Superannuation.

Proud Member of:

LEAVE A REVIEW

Tell people what you think.

Help others by sharing your experience

TESTIMONIALS

FEATURED SERVICES

LIFE INSURANCE

At GFP, we can assist you through the maze of personal risk insurances such as life, income protection, critical illness, total and permanent disability, trauma and more.

Our team of specialists will advise on the appropriate risk cover for you in view of your tax, superannuation and investment strategies. We can arrange specialised cover for your business, company directors and practising professionals.

An often forgotten yet crucial function of our risk service is managing and guiding you through any claims process. You can rely on our expertise, experience and long-standing relationships to expeditiously achieve the best outcome for your claims.

We are about results:

We have done the hard work for you – we have outstanding relationships with Australia’s top insurers.

Our research team ensures that only quality insurance providers and products with clearly defined terms and conditions pass our compliance checks. We are not aligned with or tied to any financial institution, meaning we are not manoeuvred to favour any product.

Whether you are single, married, have dependents or run a business, life insurance can play a crucial role in ensuring protection and providing financial peace of mind for you and your loved ones. Life insurance can help to:

- Provide support for dependents

- Cover any rent or mortgage obligations

- Payout debts or credit cards

- Cover estate costs

- Pay out of pocket medical expenses

- Help with covering ongoing living or business costs

SELF MANAGED SUPER FUNDS

An SMSF is one where you, as a trustee and member, have responsibility over the management, investment and administration of your self managed super fund. SMSFs are quite different from other super funds because they’re run by you, for you and any other members of your SMSF. SMSFs are established for the purpose of building retirement savings.

SMSF structures can be quite simple or complex depending on your needs. There’s a lot to consider, but you can outsource aspects, such as administration, to save you time and free you up to focus on what’s important to you.

However, self-managed retirement plans aren’t for everyone – particularly if you have lower super balances or don’t have the capacity to act as a trustee of the fund. That’s why it is important to seek advice.

The benefits of SMSFs include:

- Greater control over your super, as you make the key decisions and you’re in charge of where you invest your money.

- Flexibility and choice. You construct your fund’s investment strategy and enjoy more investment choice. The choice of investments in SMSFs is far greater than

- what other super arrangements can offer. You can invest in property, direct shares, cash, term deposits and more.

- Costs. You are in control of what services you require and how much you pay for them.

- Tax advantages. There are potential tax savings in SMSFs depending on your personal circumstances and investment strategy.

- Pool your super with family or other members of the fund, for potential cost savings.

- The potential to borrow to buy a property within your super fund.

- nsurance can be included in your SMSF to protect your income and assets, for example life insurance, total and permanent disability (TPD) and income protection.

- Planning for when you’re not around, by specifying who you want to leave your money to.

BUDGET PLANNING

Budgeting, planning and forecasting is a process for determining and detailing an organization’s and personal, long- and short-term financial goals.

Budget Planning is the key to financial freedom.

- Planning – outlines your financial direction and expectations for the next 12 month to three, five years and to retirement.

- udgeting – documents how the overall plan will be executed month to month, specifying expenditures.

- Forecasting – uses accumulated historical data to predict financial outcomes for future months or years.

Budget Planning may not sound like the most exciting thing in the world to do, but it is vital in keeping your financial house in order. Before you begin to create your budget it is important to realize that in order to be successful you have to provide as much detailed information as possible. Ultimately, the end result GFP will be able to show where your money is coming from, how much is there and where it is all going.

INCOME PROTECTION

It is among the most important insurances available today. Income Protection provides financial benefits that can generally replace up to 80% of your income in the event of serious illness or an accidental injury that prevents the policy holder from working. Income Protection Insurance usually provides cover 24/7 for illness and injuries that occur at work or at home. Income Protection Insurance can provide regular payments of ‘income’ until retirement age.

Being ill or injured is difficult enough, without the financial pressure of not being able to earn an income. You can protect your income and maintain your lifestyle. GFP planning will be able to taylor a product that suits your needs and more importantly, within your budget. GFP will be able to provide the information you need to make informed insurance decisions.

Business Overheads Cover:

This cover is a form of income protection that helps pay for business expenses if a business owner is unable to work due to sickness or injury. The benefit will cover the regular fixed operating expenses of a business if self-employed, or an income generating member of a small business.

BUSINESS INSURANCE

When you are in business there are important matters than can impact on your personal finances and have potential to directly affect your livelihood. There are a number of business insurances that should be considered among them:

Buy Sell Insurance – this insurance is designed to provide financial security among business partners and their respective estates. In the event of a partner passing away, becoming critically ill or suffering a disability, buy sell insurance provides a financial payment that allows surviving business partners to buy out the deceased owner’s interests.

The benefits of SMSFs include:

Key Man Insurance – this insurance policy provides cover against business losses that may be incurred as a consequence of the prolonged absence or death of the business owner or a key member of staff.

Overheads Insurance – this insurance provides peace of mind for meeting the ongoing commitments of business costs including wages, rent, loan repayments, utilities and other overhead expenditures required to keep a business going when a business owner suffers serious injury or illness.

Total and Permanent Disability Insurance

TPD Insurance cover provides a financial benefit for the insured when they suffer a disability that prevents them from working. Being confined to a wheelchair for the rest of your life would be a terrifying prospect for anyone. If you could never work again and needed someone to look after you permanently, how would you manage?

TPD cover pays a one-off lump sum of up to $5 million if you are totally and permanently disabled due to illness or injury. You can choose TPD cover as a stand-alone policy or combine it with your life insurance. You also elect to have cover through your superannuation.

You should consider cover if you:

- Have a family or dependants

- Have a mortgage or other debt

- Would need money to live on if you couldn’t work again

- Don’t have savings to cover unexpected expenses, for example: medical bills

- Have a business or business partner, are self-employed, or you are a company director or key employee.

TRAUMA INSURANCE

RETIREMENT PLANNING

The process of determining retirement income goals and the actions and decisions necessary to achieve those goals. Retirement planning includes identifying sources of income, estimating expenses, implementing a savings program and managing assets. Future cash flows are estimated to determine if the retirement income goal will be achieved.

There are many things to consider when planning for retirement, but the biggest question of all is: ‘can I afford to retire?’

Is $1 Million enough or do I need more. Everyone is different.

To find the answer, A GFP Planner will first consider how well you want to live during your retirement. We will look at your spending habits and this will influence how much money you need to accumulate in preparation for retiremen

How long am I likely to live? (in order to estimate how long your income needs to last) How will I manage increases in the cost of living?

If investing in shares, how can I protect my income against the effects of adverse market movements?

All of these things can affect how long your retirement savings last. The earlier you start planning for retirement the sooner you can retire.

LEGACY PLANNING

While most people have given some consideration to their legacy, most have never put it in writing, and even fewer have established a plan of action.

Most people think of legacies as inheritances they leave in their will; after they are gone. Estate Planning achieves the effective and efficient transfer of wealth to the next generation.

Legacy is a collage of your actions, contributions and achievements. Positive or negative, big or small, what you do, give and accomplish defines your legacy. Legacy Planning helps you discover ways to use your time, talent and money to make a lasting impression on those you love and the causes you believe in.

Living legacies are a hidden gem that few consider or know about. Living legacies can range from philanthropic planning to passing along family values to engaging family and community. They allow you to see the impact your generosity has on your favorite charities, your family, your business and your community. We have a myriad of tools to help you plan your legacy. Legacy Planning, is so much more than Estate Planning.

LEAVE A REVIEW

Tell people what you think.

Help others by sharing your experience

CALL US ON 1300 GF PLAN OR 4648 0431

Blog

Entering aged care – 5 key questions

Entering aged care is a significant decision that requires careful consideration of various factors. Key questions to address include: What are the costs associated with different types of aged care, and how will they impact your finances? What services and support are provided, and do they meet your specific needs? How will the chosen facility ensure your comfort and quality of life? What are the eligibility criteria and application process for accessing aged care? Finally, how does the facility’s location and environment align with your preferences for proximity to family and familiar surroundings? Thoroughly evaluating these aspects can help ensure a smooth transition and a positive experience in aged care.

Where to start with personal insurance

Starting with personal insurance involves evaluating your unique needs to ensure comprehensive protection for yourself and your family. Begin by identifying the types of coverage essential for your situation, such as life insurance, income protection, or trauma cover. Assess your financial responsibilities, such as debts and living expenses, to determine the appropriate amount of coverage. Research various insurance policies and providers to find those that offer the best fit for your needs and budget. Finally, review and adjust your insurance coverage regularly to reflect changes in your circumstances or financial goals, ensuring ongoing protection and peace of mind.

Property

Investing in property offers a tangible asset that can provide both income and potential appreciation. Property investments can include residential, commercial, or industrial real estate, each with unique benefits and risks. Key factors to consider include location, market conditions, and the potential for rental income or capital growth. Conducting thorough research and analysis helps in making informed decisions about property value, rental yields, and future developments. Balancing property investments with other asset classes can create a diversified portfolio that supports long-term financial stability and growth.

Cash Investing

Cash investing involves placing your funds in low-risk, liquid assets to preserve capital and earn modest returns. This investment strategy typically includes options like savings accounts, term deposits, and money market funds, which offer stability and easy access to your money. While cash investments provide safety and liquidity, they usually offer lower returns compared to other asset classes. They are ideal for short-term goals or as a conservative component of a diversified portfolio. Balancing cash investments with other growth-oriented assets can help manage risk while still working towards your financial objectives.

Irecon Insurance services Pty Ltd is a Corporate Authorised Representative of Insurance Advisernet Australia Pty Ltd. AFSL 240549. Corporate Authorised Representative No. 355956. Irecon is a general Insurance Advising firm offering services to a wide range of corporate, commercial and retail clients. Whilst the company caters to a diverse group of clientele, its specialist area of operation is within the construction and related industry market segment. We recommend them for general Insurance.

Irecon Insurance services Pty Ltd is a Corporate Authorised Representative of Insurance Advisernet Australia Pty Ltd. AFSL 240549. Corporate Authorised Representative No. 355956. Irecon is a general Insurance Advising firm offering services to a wide range of corporate, commercial and retail clients. Whilst the company caters to a diverse group of clientele, its specialist area of operation is within the construction and related industry market segment. We recommend them for general Insurance.